Life Insurance and Accidental Death & Dismemberment Insurance (and more)

Overview and Eligibility

It’s important to plan for your family’s financial security in case the unexpected happens. That’s why the Company provides basic life insurance and accidental death & dismemberment (AD&D) insurance at no cost to all eligible employees.

For additional coverage, you may also choose to enroll in voluntary group whole life insurance. Learn more below.

Effective 8/1/21, benefits are equal to: Basic life: $50,000 / AD&D: $50,000 (see below for grandfathered employees)

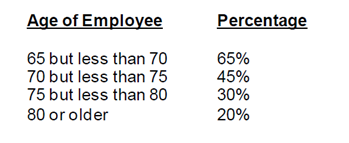

Age Reduction Rules When you turn 65 years of age and beyond, you will be notified by MetLife that the amounts of your Basic Life and Accidental Death & Dismemberment insurance on and after age 65 will be determined by applying the appropriate percentage from the following table to the amount of your insurance in effect on the day before your 65th birthday.

Who’s eligible?

Telepictures, WAG, Warner Horizon, SHED and TV Affiliates non-union full-time employees will be automatically enrolled in Company-paid basic life and AD&D coverage. For eligibility details, refer to the Summary Plan Description and List of Participating Employers.

How to enroll

Enrollment is automatic but you must complete the beneficiary form

Submit the beneficiary form to Benefits using the “Submit” button located on the upper right corner (drag & drop).

More about basic life and AD&D - MetLife (effective 8/1/22)

Life Insurance & AD&D Benefit Summary / Certificate of Coverage

Life Insurance & AD&D Benefit Summary / Certificate of Coverage / Waiver / Imputed Income (for grandfathered employees)

Life Insurance Beneficiary Form (requires action on your part)

Learn More about additional services provided by MetLife at no additional cost including:

Grief Counseling: Meet in person or by phone with a licensed counselor to help cope with a loss or major life change.

Funeral Discounts & Planning Service: Get access to the largest network of funeral homes and cemeteries to pre-plan with a counselor and receive discounts on funeral services.

Will Preparation: Ensure that your final wishes are clear with a do-it-yourself online service.

Delivering the Promise / Checklist: Specialists are ready to provide assistance with:

completing & filing life insurance claims

contacting Social Security or other government agencies about benefits

locating local grief counseling and support resources

Voluntary Group Whole Life

If you are interested in obtaining additional coverage at your own cost, you have a one-time opportunity to enroll in Trans$ureSM, a voluntary whole life insurance policy through Transamerica. Whole life insurance can be a valuable supplement to employer-provided life insurance because it helps protect for an entire lifetime, not just while you are part of the workforce. You must enroll within 30 days of your initial eligibility. If you don’t, you’ll miss the opportunity to enroll at group rates.

Key features

• Helps provide financial protection for your family

• Pays a death benefit that can be used for final expenses, college tuition, living expenses, or as an inheritance

• Accumulates cash value (with a minimum 4% interest rate) that can be borrowed against while alive

• Portability so you can continue your coverage at the same cost even if your employment ends

• Directly billed by Transamerica for the full cost of coverage (not through payroll deductions)

How to enroll

1. Complete the Transamerica Group Whole Life Enrollment Form.

2. Submit the enrollment form to Benefits using the Secure Web Link for Employee Forms (drag & drop).

3. Complete the Electronic Funds Transfer Authorization Form and submit it directly to Piedmont Pays per the instructions provided. This step is required to complete your enrollment.

As required each year under the Employee Retirement Income Security Act of 1974, as amended (ERISA), TW Ventures Inc. files financial information on its benefit plans with the Internal Revenue Service. ERISA also requires that a summary of this information be distributed to employees. Click here for information on the health and welfare benefit plans in effect from August 1, 2023 through July 31, 2024. The format of the Summary Annual Report is prescribed by Department of Labor regulations. Please note that these plans may not be applicable to you or your production.

MetLife’s Notice of Privacy Practices